Bodie Kane Marcus Investments 10th Edition is the definitive guide to investment theory and practice, providing a comprehensive overview of the field for students and practitioners alike. This edition has been thoroughly revised and updated to reflect the latest developments in the investment landscape, including the impact of technology, globalization, and regulatory changes.

This comprehensive textbook covers all aspects of investment management, from the core concepts of risk and return to the latest advances in portfolio construction and performance measurement. With its clear and engaging writing style, Bodie Kane Marcus Investments 10th Edition is the perfect resource for anyone looking to gain a deep understanding of the investment process.

1. Introduction

The 10th edition of Bodie Kane Marcus Investments provides a comprehensive and up-to-date overview of the principles and practices of investment. This edition incorporates the latest developments in investment theory and practice, including the impact of technology, globalization, and regulatory changes.

This edition is designed to help investors make informed decisions about their investments. It provides a solid foundation in investment fundamentals, financial markets, and security valuation. It also covers portfolio management, investment analysis, and ethical and regulatory considerations in investments.

2. Investment Fundamentals

Investment fundamentals are the core concepts that underpin investment theory and practice. These concepts include risk and return, diversification, and asset allocation.

Risk and Return

Risk is the uncertainty associated with an investment. The higher the risk, the greater the potential for both gain and loss. Return is the profit or loss that an investment generates. The expected return is the average return that an investment is expected to generate over time.

Diversification

Diversification is the process of spreading your investments across different assets. This helps to reduce risk because the performance of different assets is not perfectly correlated. When one asset performs poorly, another asset may perform well.

Asset Allocation

Asset allocation is the process of dividing your investments into different asset classes, such as stocks, bonds, and cash. The optimal asset allocation for you will depend on your risk tolerance, investment horizon, and financial goals.

| Investment Vehicle | Characteristics |

|---|---|

| Stocks | Ownership shares in a company. Offer potential for high returns, but also carry high risk. |

| Bonds | Loans made to companies or governments. Offer lower returns than stocks, but also carry lower risk. |

| Mutual Funds | Pooled investment vehicles that invest in a diversified portfolio of stocks, bonds, or other assets. Offer lower risk than individual stocks or bonds, but also lower potential returns. |

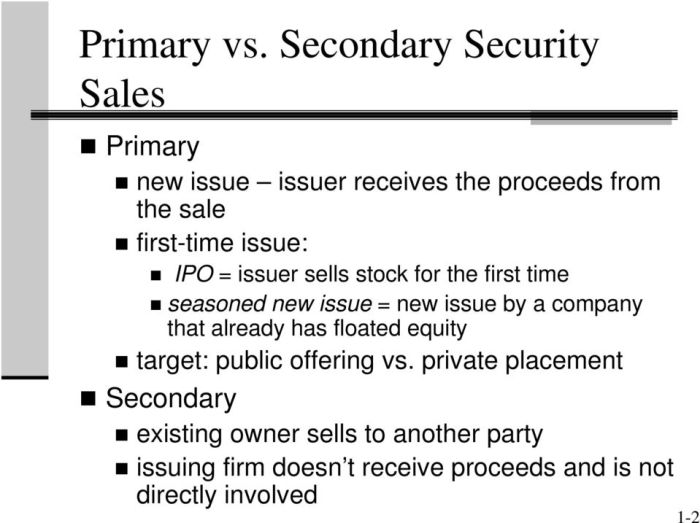

3. Financial Markets and Instruments

Financial markets are where buyers and sellers of financial instruments come together. The major financial markets include the equity market, the fixed income market, and the derivative market.

Equity Market

The equity market is where stocks are traded. Stocks represent ownership shares in a company. The equity market is the most volatile of the major financial markets, but it also offers the potential for the highest returns.

Fixed Income Market, Bodie kane marcus investments 10th edition

The fixed income market is where bonds are traded. Bonds are loans made to companies or governments. The fixed income market is less volatile than the equity market, but it also offers lower potential returns.

Derivative Market

The derivative market is where derivative instruments are traded. Derivative instruments are contracts that derive their value from the underlying asset. The derivative market is used to hedge risk and speculate on the future price of assets.

Financial Intermediaries

Financial intermediaries play a vital role in facilitating investment transactions. These intermediaries include banks, investment banks, and brokerage firms. Financial intermediaries provide a variety of services, such as underwriting, trading, and custody.

Commonly Asked Questions: Bodie Kane Marcus Investments 10th Edition

What is the purpose of Bodie Kane Marcus Investments 10th Edition?

Bodie Kane Marcus Investments 10th Edition is a comprehensive guide to investment theory and practice, providing a deep understanding of the investment process for students and practitioners alike.

What are the key features of Bodie Kane Marcus Investments 10th Edition?

Bodie Kane Marcus Investments 10th Edition is known for its clear and engaging writing style, comprehensive coverage of the field, and up-to-date information on the latest developments in the investment landscape.

Who should read Bodie Kane Marcus Investments 10th Edition?

Bodie Kane Marcus Investments 10th Edition is an essential resource for anyone serious about investing, including students, practitioners, and anyone else looking to gain a deep understanding of the investment process.